7 Easy Facts About Unicorn Finance Services Explained

Wiki Article

About Unicorn Finance Services

Table of ContentsThe Only Guide for Unicorn Finance Services8 Easy Facts About Unicorn Finance Services ExplainedThe Unicorn Finance Services StatementsUnicorn Finance Services for BeginnersWhat Does Unicorn Finance Services Mean?

Never sign blank types or leave information for the broker to complete later. If you feel you're being pressed into signing, request for more time to think of the car loan. Or go to another broker. If you're unhappy with the lending advice you have actually gotten or costs you have actually paid, there are steps you can take.Clarify the problem as well as how you would certainly like it taken care of. If the problem isn't taken care of, make a problem to your broker's business in creating. See how to complain for aid with this. If the issue is still not resolved, get in touch with the Australian Financial Complaints Authority to make a grievance as well as break out, independent disagreement resolution.

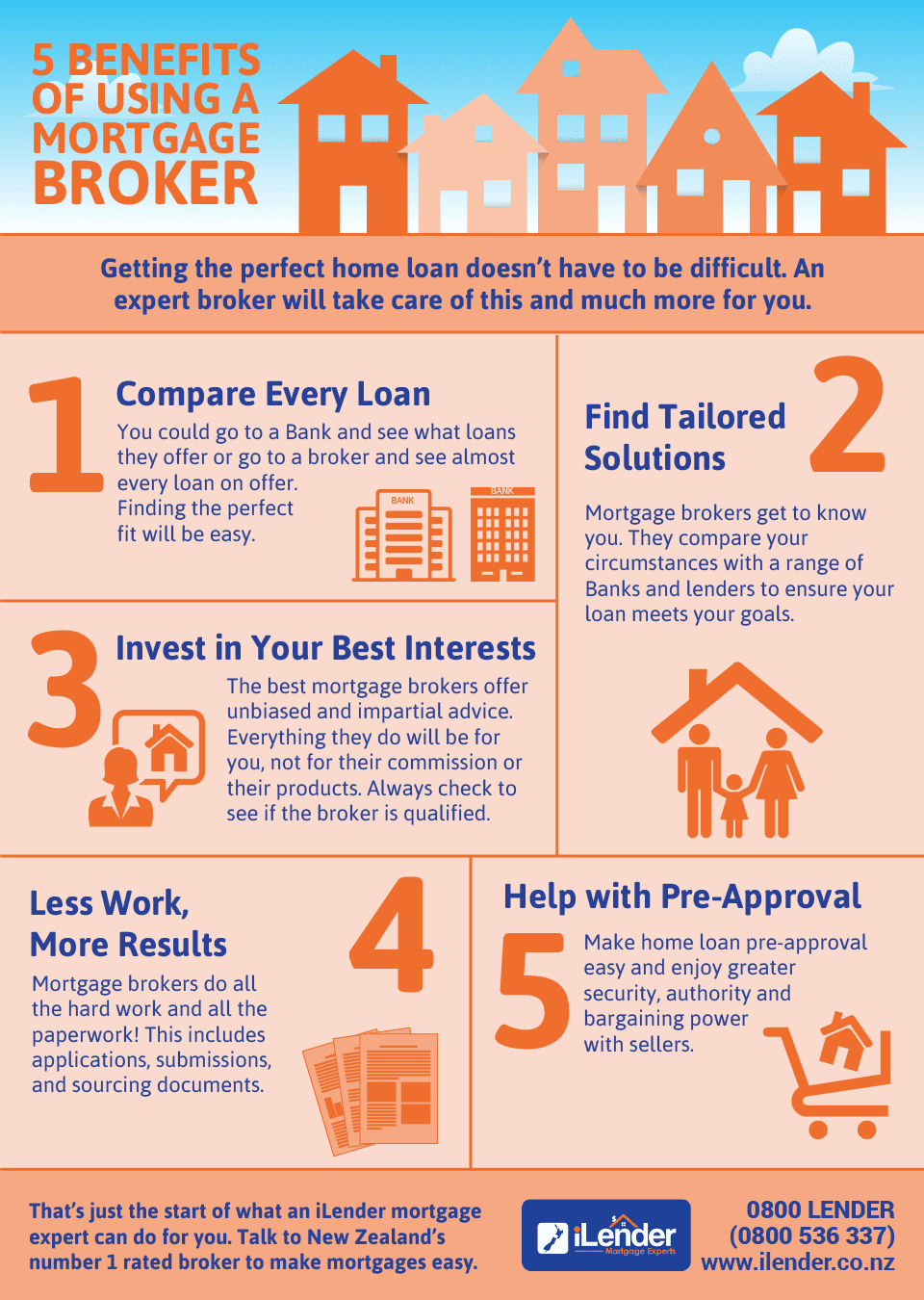

There are numerous alternatives when it pertains to discovering finding a home mortgage. At the end of the day, you'll desire something that makes the process as structured as well as trouble-free as feasible. Instead approaching a bank instantly, have you ever before taken into consideration using a mortgage broker? Enlisting the solutions of a home mortgage broker has a number of advantages that can make locating your very first home car loan a seamless experience, enabling you as well as your household to focus on looking for the excellent residential property.

Or finish our telephone call request kind and also we'll call you! PLEASE NOTE: The information consisted of in this short article is proper at the time of publishing as well as goes through change. It is meant to be of a basic nature only. It has actually been prepared without taking into consideration anybody's purposes, financial circumstance or demands.

Rumored Buzz on Unicorn Finance Services

Home loan brokers generally have access to a panel of no much less than 20 to 30 lenders. This implies they can provide you with a selection of in between one thousand and two thousand item choices, throughout a series of lending institutions. The variety of products available to you is as a result far broader than any kind of single lender will certainly have if you attempt to go directly to a loan provider for your home mortgage.

In enhancement to accessing several products at one solitary point, mortgage brokers are additionally a whole lot much more versatile in terms of job timings, and also they're frequently offered to satisfy when as well as where it fits you. After meeting you and also getting all the essential files for a home mortgage application, a broker can do the legwork to get your application accepted whilst you can remain to tackle your active day.

If you want openness, simplicity and also option when it comes to your home mortgage, connect to us today to talk with among our experienced YBR Residence Loans brokers - Loan broker Melbourne.".

6 Simple Techniques For Unicorn Finance Services

Are you thinking about acquiring a residence however feeling overwhelmed by the procedure of safeguarding a mortgage? A home mortgage broker may have the ability to help you in finding the ideal home financing. What does a home mortgage broker do, and also just how do you understand if they are ideal for you? A home loan broker is an intermediary who collaborates with numerous lending institutions to locate the very best home loan items for their customers.This payment design offers a monetary incentive for brokers to find the very best financing alternatives for their customers, and also they are obliged to be clear concerning their payment rates and fees. While dealing with a home mortgage broker can be valuable, customers need to meticulously review their funding records and ask questions regarding fees before accepting deal with a broker.

What are the advantages of working with a home loan broker? On the whole, making use of a home loan broker for your mortgage simply makes life easier. Here are some added benefits that make utilising a broker rewarding: A home mortgage broker has access to a wide variety of lending institutions and can supply you with a variety of lending choices that you might not be able to locate by yourself.

Mortgage brokers have partnerships with several lenders, which can assist them bargain better financing conditions on your behalf. They can aid you locate a car loan with a less expensive rates of interest, far better repayment terms, or reduced costs - Refinance Melbourne. There are a few crucial pieces of information you need to know before selecting a mortgage broker.

The 4-Minute Rule for Unicorn Finance Services

Here are several of the important things you need to recognize: When choosing a mortgage broker, assess their degree of ability and also experience. Inquire concerning their past as well as market experience, and do not be hesitant to ask for recommendations. A reputable broker should be able to present you with samples of previous customers and also offer you a concept of their degree of experience (https://www.theverge.com/users/unicornfinan1).

It is necessary to recognize how the broker is made up, as well as what charges they may bill. If you have a clear understanding of how your broker's costs are being paid, you can comprehend the overall influence it has on your home loan. Lastly, assess the level of customer care provided by the home loan broker.

Search for a broker that is communicative, transparent, as well as straightforward to deal with, as this can make the mortgage application process much smoother and also much less stressful. Are you in the market for a home loan broker? One Click Life has accessibility to over 40 lenders as well as can aid you find an option, despite your situation.

Some Known Incorrect Statements About Unicorn Finance Services

If home mortgage brokers can get you a better rate, you need to seriously consider them. Are home loan brokers much better?

Report this wiki page